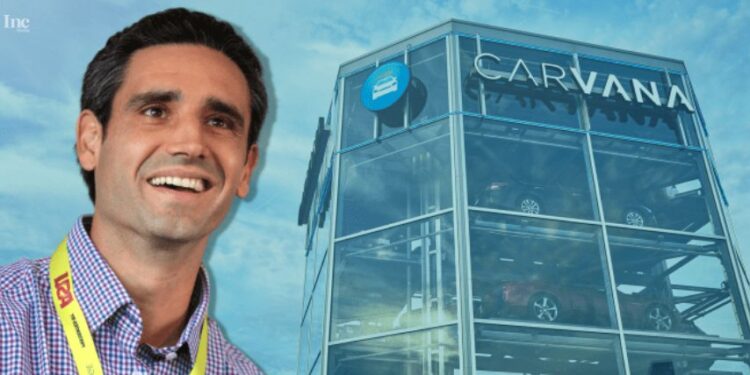

Carvana’s share price has seen a rise after the positive comment received from J.P. Morgan. The company has experienced significant price changes. Hike has come as a surprise because no one has predicted it.

J.P. Morgan is one of the leading investment firms in the world. A news release from the company can change the investors’ perspective around the globe. Thus, any small event also triggers a ripple effect in the stock market.

Carvana shares are also experiencing a similar kind of change after the release of the comment from J.P. Morgan. The analysts are very optimistic about the future of the company.

Car retailers have the potential to navigate the changing landscape and succeed in the industry. The transportation phase will open new opportunities for the company. Carvana shares have taken off at the highest price with over 700% growth.

In the comment, J.P. Morgan praised Carvana for their online used car retailer services. Bank have also upgraded the stock from the Neutral, which was earlier underweight. The stock price has seen a rapid increase after the news reached the mainstream, boosting the overall price of the stock. Price target by 60% to 40$ from $25.

J.P. Morgan has appreciated the company for improving productivity, balancing costs and enhancing the company’s culture to meet modern-day customer needs. The tiny moves will strengthen the position of the company while building trust. Companies can deliver better returns on their investment with their growth chart.

Top analysts added that the investors would better appreciate Carvana for their initiative and improvement. The company is capable of achieving new heights with the change. It will limit the downside to near and medium-term estimation, but the company would perform better in the long run.

An the analyst said the higher the interest rates, the more profitable the firm would become. The company may look into these factors and make needed changes.

Although the numbers seem optimistic this year, the company also has to look into the rising competition. Innovation and adaptation of new technology are essential to keep the company relevant in the industry.

Modern-day services-based companies face challenges in dealing with the increasing competition that uses the latest technology to penetrate the market. Any newly started company can disrupt the market and achieve success with minimum investment.

As the company becomes more active in serving customers online, the new retail customers may visit the portal to purchase the services. New funnels could be open to attract new customers, giving you better control over the development of the business.

Besides the car retail services, the insurance business would also be a substantial revenue-pumping product that Carvana can leverage to increase its revenue. The insurance premium would keep the cash flow positive throughout the year.

When the company is doing well, more customers will join and try to promote the brand in their circle. Focusing on the customers’ needs and delivering the highest quality products would improve brand awareness in the industry.

Carvana has developed a good reputation in the industry. Brand value is consistent throughout the year; thus, the chance of the company doing well in the future would be high. Therefore, several independent investors and prominent institutes are increasing the stock price.

The 700% growth rate within a year is the most significant milestone that the company has achieved since its listing on the stock market. It shows that the trust in the brand is rising. Financial statements are positive and predicting the growth in the future.

After the statement from reputable firms like J.P. Morgan, the company may see more growth in the share price in the coming months. People will put their money and enjoy a better outcome in the session.

Whenever J.P. Morgan makes an announcement or releases a comment on the publically traded firm, global investors begin analysing the firm to identify future growth. Some investors unquestioningly believe the statements of the big investment firms and invest their money in the stock, pushing the price high.

Carvana would also experience steady growth in its stock price in the future. We may see more customers buying the stock, which will lead to pushing the price higher. Carvana would also benefit from the price hike in the business.

More customers would reach out to the company to experience their products. It is an excellent opportunity for the company to capture the large market in the active region. Also, look for the expansion in the market where demand is high.

The right strategy should be to grow the footfall in the region with high demand. Carvana has shown a remarkable comeback after the pandemic. The price rise indicates the demand for retail car showrooms is growing. People are looking for second-hand cars from reputed sellers. Carvana would have a better chance to become the industry leader in this sector.

The Inc Media is one of the most renowned global Online Business Magazines, that carries news stories about entrepreneurship, small business management, and business. Being a global business magazine, we carve for influential stories and try to take them globally to uplift the business standards and educate the people about new innovations in the business world...

The Inc Media is one of the most renowned global Online Business Magazines, that carries news stories about entrepreneurship, small business management, and business. Being a global business magazine, we carve for influential stories and try to take them globally to uplift the business standards and educate the people about new innovations in the business world...