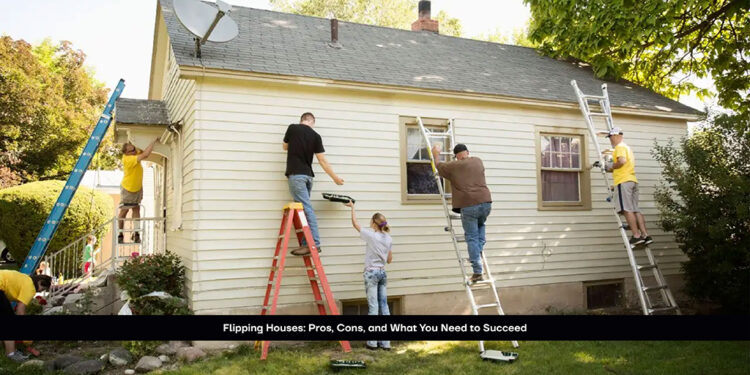

Flipping houses is a popular real estate strategy that involves buying properties, renovating them, and then selling them for a profit. This method appeals to many because of the potential for high returns in a relatively short period. The primary benefit of flipping houses is the ability to earn significant profits. When executed well, the margin between the purchase price, renovation costs, and the selling price can lead to lucrative financial outcomes. Moreover, the sense of accomplishment from transforming a property and seeing it appreciate in value is rewarding, making flipping an attractive option for many investors seeking fast returns.

However, the risks involved in flipping houses cannot be ignored. One of the main drawbacks is the high upfront cost. Purchasing a property, financing renovations, and covering holding costs like property taxes, utilities, and insurance can add up quickly. Additionally, unexpected expenses may arise during the renovation process, such as structural issues or outdated wiring. These unforeseen costs can quickly eat into any potential profits. To mitigate these risks, it’s essential to have a thorough inspection done before purchasing, along with a detailed renovation budget and timeline. Without proper planning, a flip can turn into a financial drain rather than a rewarding investment.

Another potential downside of flipping houses is the market risk. Real estate values can fluctuate based on the economy, interest rates, and neighborhood trends. If the market takes a downturn during your renovation period, the property may not sell for as much as expected, or it may take longer to find a buyer. This is especially true in slower markets where demand is lower. Flipping houses in areas with high demand and steady appreciation rates can help reduce these risks, but no investment is entirely free from market uncertainty. It’s crucial to conduct comprehensive market research to better understand potential risks before committing to a project.

Time is also a critical factor when flipping houses. Renovations can take longer than anticipated, especially if you’re managing the project yourself. Delays in construction, sourcing materials, or contractor issues can push back the timeline and eat into your profits. Additionally, holding costs—such as mortgage payments and property taxes—continue to accumulate during the renovation period. To minimize time-related costs, it’s crucial to have a reliable team of contractors and to establish a realistic renovation timeline. Time is money in the world of house flipping, so efficiency and planning are paramount to success.

Despite the risks, there are ways to increase your chances of success in house flipping. First, choose properties in locations that are in high demand, with good schools, access to public transport, and future growth potential. These factors can help ensure that the property will sell quickly and at a favorable price. Additionally, having a strong understanding of renovation costs, including labor and materials, will help you stay on budget and avoid overspending. Knowledge of local real estate trends, the ability to identify underpriced properties, and an eye for design will also set you apart from other investors in the market.

Networking is another key factor in a successful house flip. Connecting with real estate agents, contractors, and other investors can provide valuable insights and resources. Real estate agents can help identify good properties, while contractors can give accurate estimates and timelines for renovations. Moreover, working with professionals who have experience in flipping houses can provide guidance on what improvements will yield the highest return on investment. Building a reliable team of experts will help streamline the process and avoid costly mistakes. A strong network is a critical asset for anyone looking to flip houses successfully.

In conclusion, flipping houses offers the potential for high profits, but it also comes with significant risks and challenges. The ability to succeed in house flipping depends on careful planning, a solid understanding of the market, and efficient project management. While unexpected costs and market fluctuations can present obstacles, with the right approach and preparation, flipping houses can be a highly rewarding venture. Whether you’re a seasoned investor or just starting, understanding the pros and cons of flipping houses will help you make informed decisions and increase your chances of success in the real estate market.

The Inc Media is one of the most renowned global Online Business Magazines, that carries news stories about entrepreneurship, small business management, and business. Being a global business magazine, we carve for influential stories and try to take them globally to uplift the business standards and educate the people about new innovations in the business world...

The Inc Media is one of the most renowned global Online Business Magazines, that carries news stories about entrepreneurship, small business management, and business. Being a global business magazine, we carve for influential stories and try to take them globally to uplift the business standards and educate the people about new innovations in the business world...